sales@briocean.com

sales@briocean.com

English (EN)

English (EN)

sales@briocean.com

sales@briocean.com

English (EN)

English (EN)

About Us · Events · / 2025-09-02 14:32:00

Briocean’s Semiconductor Market Intelligence Report is published monthly to provide end customers, suppliers, and strategic partners with timely, data-driven insights into the semiconductor landscape. The report encompasses macroeconomic updates, industry developments, end-market trends, core product pricing, and key market shifts. By combining in-depth analysis with forward-looking perspectives, we aim to help stakeholders identify opportunities, anticipate challenges, and make well-informed strategic decisions.

1. Macro Environment

1.1 Industry Policy

U.S. Plans High Tariffs on Imported Semiconductors

U.S. Government Considers Equity for Subsidies

South Korea Launches 45.8 Trillion Won Support Plan to Strengthen Semiconductor Supply Chain

Fire at Japan’s Kanto Denka Kogyo NF₃ Factory Causes Semiconductor Gas Supply Instability

China's Cyberspace Administration Urges Tech Companies to Accelerate Local AI Chip Substitution

1.2 Economic Indicators

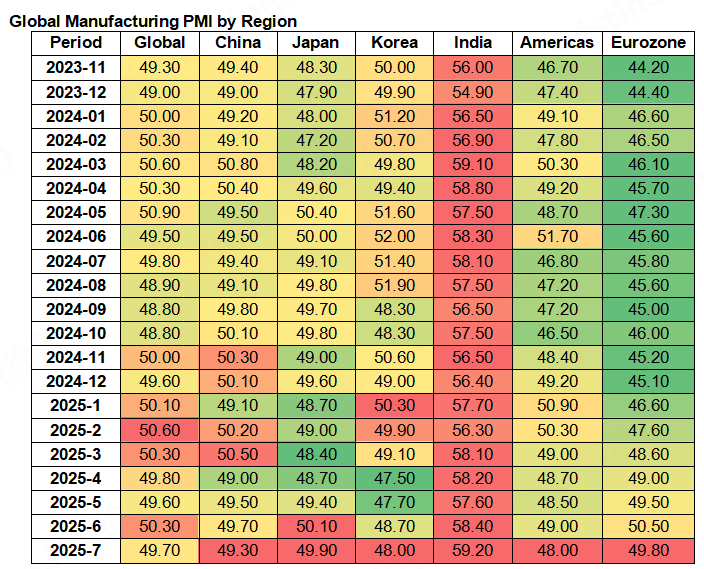

Global Manufacturing PMI Continues to Decline to 49.7, Weak Global Demand Affects Semiconductor Output

Source: Wind

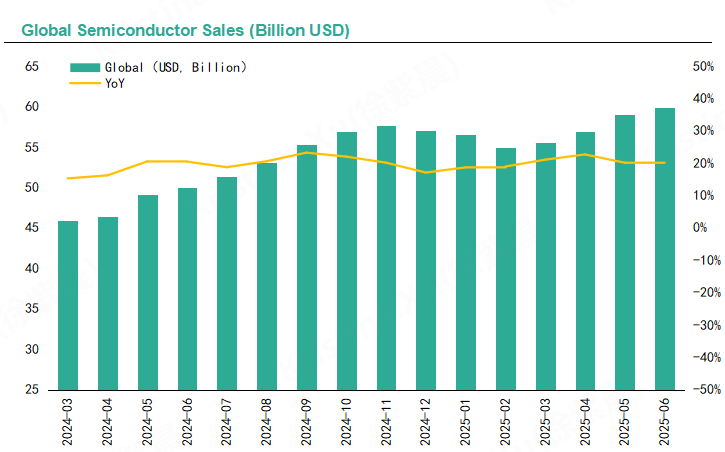

June Global Semiconductor Sales Hit Record High, Strong Performance in Asia-Pacific

Source: SIA

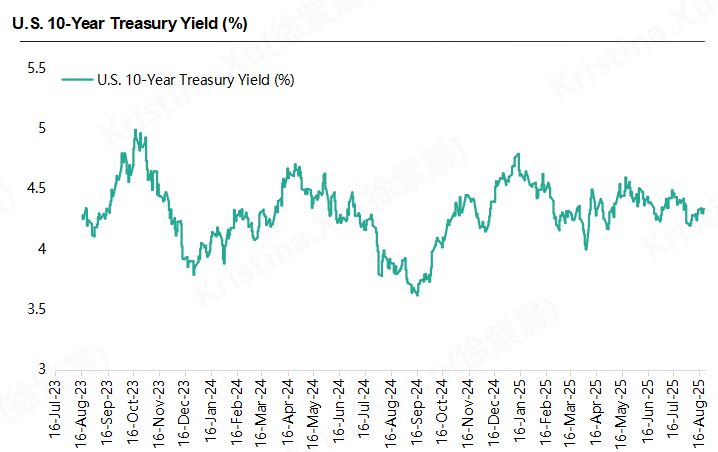

U.S. 10-Year Treasury Yield: Volatility in July-August, Diverging Market Expectations

Source: Investing

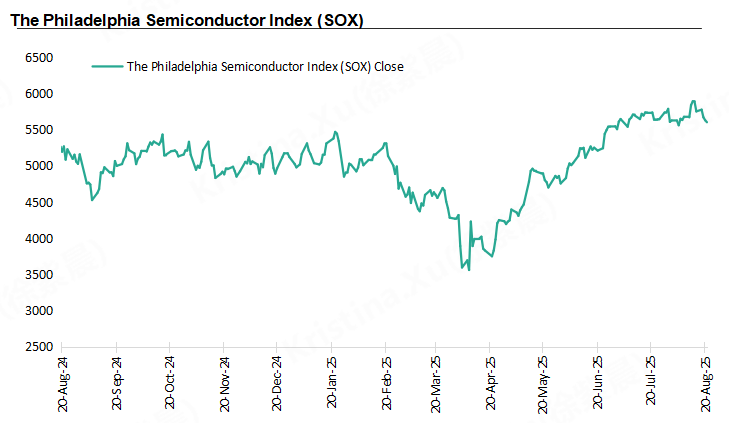

Philadelphia Semiconductor Index (SOX) Performance Analysis for July-August: High Volatility and Market Confidence Test

Source: MacroMicro

2. Semiconductor Industry Updates

2.1 Short-term Implications

Cambricon/Hygon: Chinese Chip Concept Stocks Surge, Market Sentiment High

Samsung: HBM4 Verified by NVIDIA, Pre-production Planned for End of August

SK Hynix: Explosive Demand for HBM3E, Significant Revenue Contribution

Micron: Layoffs and Cost-Cutting Focused on HBM and High-Margin Memory

NVIDIA: Launch of Jetson AGX Thor Platform

2.2 Mid-term Implications

Renesas: Released RZ/G3E MPU and RA8P1 MCU for Industrial/Human-Machine Interface and High-Performance Control

DeepSeek: Released DeepSeek-V3.1, Supporting FP8 Precision

Microsoft: Windows 11 Update Causes SSD "Drive Drop" Issues

STMicroelectronics: Released Q2 Results and Reaffirmed Acquisition of NXP Sensor Business, MEMS Maintains Double-Digit Growth

NXP: Q2 Results Exceeded Expectations and Advancing Sensor Business Sales

2.3 Long-term Implications

Huawei: Achieving Full Industry Chain Localization of Kirin Chips

TSMC: Gradual Exit from 6-inch Production Lines within Two Years, Focus Resources on 12-inch and Advanced Packaging/Process

NVIDIA: Blackwell/Rubin Generational Transition and Compliance Variants in China, Reshaping AI Supply Chain Quotas

3. Application Updates

3.1 Artificial Intelligence

Intel Received a $2 Billion Investment From SoftBank to Enhance AI Chip and Foundry Manufacturing

Google will Invest an Additional $9 Billion in the U.S. to Expand Cloud Computing and AI Infrastructure

3.2 New Energy

Sungrow Plans to Build a Hydrogen Electrolyzer Plant in Oman, Expanding its Footprint in the Middle Eastern Hydrogen Market

CCAG Plans to Build a Factory in Europe, Accelerating its Global Expansion

3.3 Consumer Electronics

Xiaomi Released its Q2 2025 Financial Report, with Global Smartphone Market Share Reaching 14.7%

AgiBot Received a Multi-million Yuan Order From Fulin Precision, Advancing Industrial Embodied AI Toward Large-scale Commercial Deployment

3.4 Industrial

Foxconn Industrial Internet Posted Record-high Performance in the First Half of 2025, With Net Profit Increasing by 38.6%

3.5 Automotive

Longhorn Auto Plans to Raise Up to ¥1.105 Billion Through a Private Placement to Expand Production Lines in Shenzhen and Huizhou

3.6 Communication

China Mobile Awarded an AI Inference Device Centralized Procurement Project Worth $5.112 Billion, With Companies Like ZTE Among the Winners

3.7 Medical Equipment & Devices

Mindray's Wuhan Base Officially Opened, With a Total Investment of ¥4.5 Billion

4. Product Updates

4.1 Memory Chips

In August, Memory Chip Prices Across the Board Increased, With Structural Adjustments on the Supply Side

4.2 GPU

Product Iteration Accelerates, AI GPU Leasing and Substitution Trends Are Significant

4.3 CPU

Server CPU Pressures Rise, Starting Price Wars; Consumer Market Shows Supply and Demand Divergence

The content above represents a selected excerpt from our latest market intelligence report. For comprehensive coverage, in-depth analysis, and additional industry insights, don't hesitate to get in touch with us at marketing@briocean.com to request the full report.

Follow us on LinkedIn to receive the latest QA and market updates!

RECENT POSTS