sales@briocean.com

sales@briocean.com

English (EN)

English (EN)

sales@briocean.com

sales@briocean.com

English (EN)

English (EN)

About Us · Events · / 2025-08-19 14:45:46

Briocean’s Semiconductor Market Intelligence Report is published monthly to provide end customers, suppliers, and strategic partners with timely, data-driven insights into the semiconductor landscape. The report encompasses macroeconomic updates, industry developments, end-market trends, core product pricing, and key market shifts. By combining in-depth analysis with forward-looking perspectives, we aim to help stakeholders identify opportunities, anticipate challenges, and make well-informed strategic decisions.

1. Macro Environment

1.1 Industry Policy

U.S. and EU finalise semiconductor trade framework, tariffs set at 15%

U.S. eases export restrictions on some NVIDIA AI chips to China

U.S. eases EDA software export restrictions to China

U.S. and China to hold Stockholm trade talks, focus on tariffs and other issues

Japan and South Korea drive semiconductor resurgence with AI-focused investments

1.2 Economic Indicators

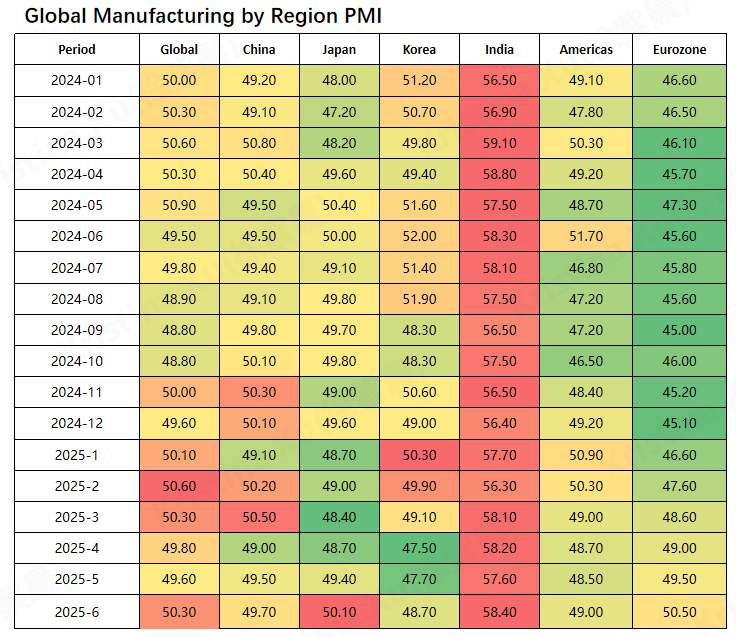

Global Manufacturing Cautiously Stabilises at 50.3 in June, Yet Regional Disparities Shape Semiconductor Demand Outlook

Source: Wind

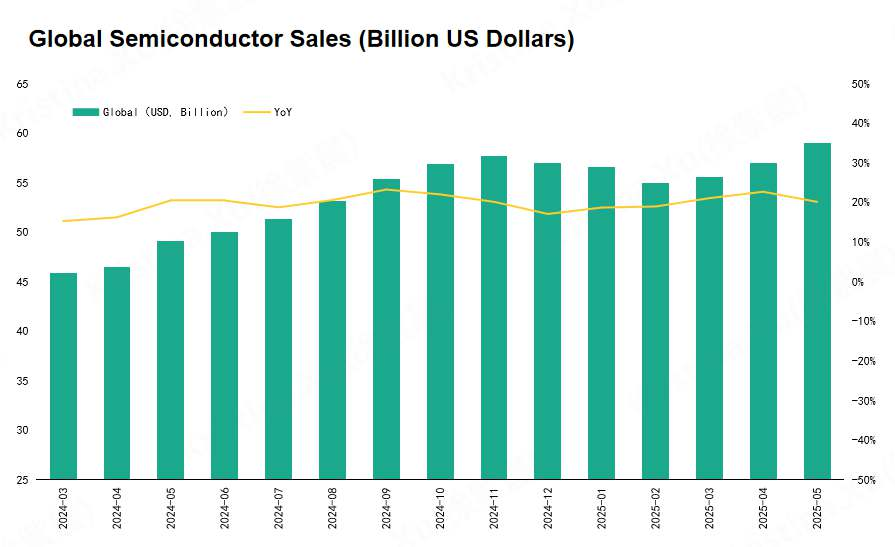

Global Semiconductor Sales Sustain Strong Growth Momentum in May 2025, Led by Americas and Asia Pacific

Source: SIA

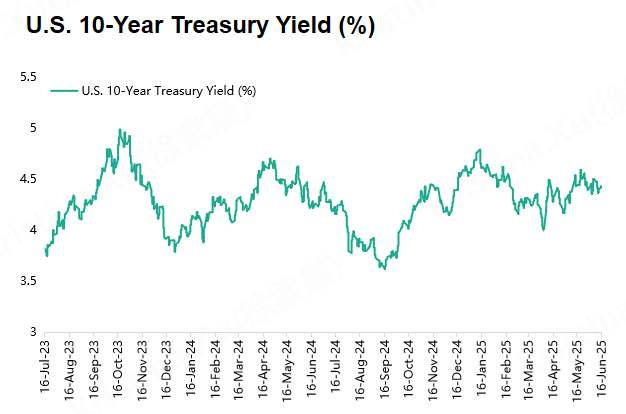

US 10-Year Treasury Yields: Navigating Elevated Levels and Volatility in June/July 2025

Source: Investing

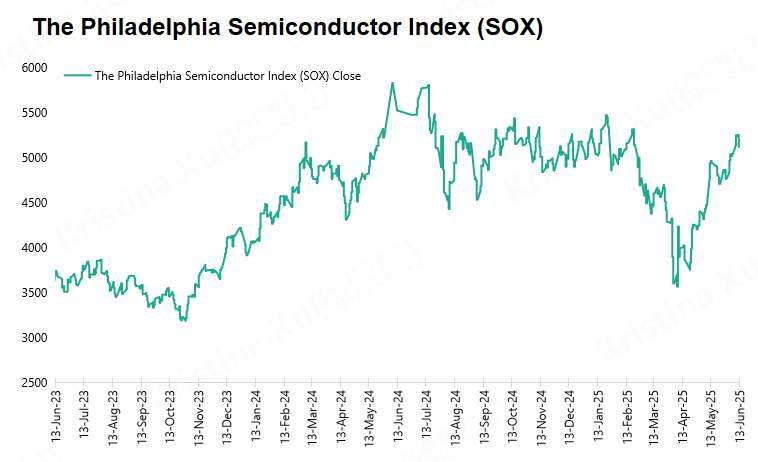

Philadelphia Semiconductor Index (SOX): Sustained Rally into June and July 2025 Signifies Robust Investor Confidence

Source: MacroMicro

2. Semiconductor Industry Updates

2.1 Short-term Implications

NVIDIA & AMD: U.S. approval of H20 GPU and MI308 AI chip sales to China, easing China's arithmetic shortage

Micron, SK Hynix, Samsung: HBM price war and DDR4 shutdown pressure

Broadcom's shares fell by 3.34% on July 22nd, impacted by VMware's maintenance and partner program adjustments

Texas Instruments lowered its Q3 revenue guidance for the 2025 fiscal year. Q3 revenue guidance for fiscal year 2025, shares plummeted more than 11% after hours

TSMC Q2 net profit jumped 61% year-on-year, 2nm process 2025H2 mass production, monthly production capacity expanded to 100,000 tablets in 2026

STMicroelectronics acquisition of NXP's sensor business: counter-cyclical investment and strategic adjustment

2.2 Medium-term Implications

Microchip Technology and Delta Electronics signed a SiC cooperation agreement

Renesas Electronics launched a new type of 650V/1200V SiC Schottky diode

Marvell and TSMC to cooperate in the development of the following 3nm AI custom ASIC and silicon photonics technology

Changxin storage: China's rise in the power of storage, and gradually challenge the global storage market

2.3 Long-term Implications

SK Hynix 2025 Q1 DRAM sales first exceeded Samsung, released HBM4/HBM4E plan

Samsung Electronics breaks through the threshold of the sixth generation of 10nm-class DRAM yields, plans to mass-produce the sixth generation of HBM4 in the second half of the year

3. Application Updates

3.1 Artificial Intelligence

Intel announces massive global layoffs, cancels two EUR 10 billion wafer fabs in Germany and Poland

Huawei Cloud releases Pangu 5.5 large model, announces CNY 150 million ecosystem incentive fund

3.2 New Energy

Tesla invests CNY 4 Billion to build its first grid-scale energy storage plant in China

CATL’s “factory-in-a-factory” model launches in Chongqing to supply batteries for AITO vehicle

3.3 Consumer Electronics

Apple enters Saudi market, first physical store to open in 2026

Unitree Robotics submits IPO filing, eyes title of "first quadruped robot stock

3.4 Industrial

Schneider Electric opens AI Innovation Lab in Beijing Yizhuang, China becomes its only all-business R&D base

3.5 Automotive

Volkswagen invests EUR 2.5 billion more in Hefei to make it a global EV flagship base

3.6 Telecommunication

China Telecom completes Phase 1 of Poyang Lake AI data center, 300P compute power goes live

3.7 Medical Equipment & Devices

- Zimmer Biomet acquires Monogram Technologies for USD 177 million, expands surgical robot portfolio

4. Product Updates

4.1 Memory Chips

DRAM prices surged across the board, with DDR4 posting the largest monthly increase in a decade

4.2 GPU

AI demand drives advanced capacity expansion, with NVIDIA commanding over 70% of industry capacity

4.3 MCU

Demand growth in new energy vehicles and other sectors drives price increases and shortages of automotive-grade MCU chips

The content above represents a selected excerpt from our latest market intelligence report. For comprehensive coverage, in-depth analysis, and additional industry insights, don't hesitate to get in touch with us at marketing@briocean.com to request the full report.

Follow us on LinkedIn to receive market updates!

RECENT POSTS