sales@briocean.com

sales@briocean.com

English (EN)

English (EN)

sales@briocean.com

sales@briocean.com

English (EN)

English (EN)

About Us · Events · / 2025-11-04 15:54:29

Briocean’s Semiconductor Market Intelligence Report is published monthly to provide end customers, suppliers, and strategic partners with timely, data-driven insights into the semiconductor landscape. The report encompasses macroeconomic updates, industry developments, end-market trends, core product pricing, and key market shifts. By combining in-depth analysis with forward-looking perspectives, we aim to help stakeholders identify opportunities, anticipate challenges, and make well-informed strategic decisions.

1. Macro Environment

1.1 Industry Policy

United States/China: The two national leaders met in Busan to consult on tariffs, rare earths, Nvidia and related issues

Netherlands: The Dutch government imposes a national-security intervention on Nexperia, strengthening control over critical manufacturing stages

United Kingdom: Sanctions trigger strong Chinese response as tech-trade friction deepens

Japan: The Takaichi Cabinet launches a JPY 13 trillion stimulus package focused on semiconductors and AI

United States / Saudi Arabia: Advancing semiconductor dialogue and exploring cooperation opportunities

United States / Malaysia: Signing of reciprocal trade agreement places Malaysia’s semiconductor supply chain under U.S. “appropriate consideration”

1.2 Economic Indicators

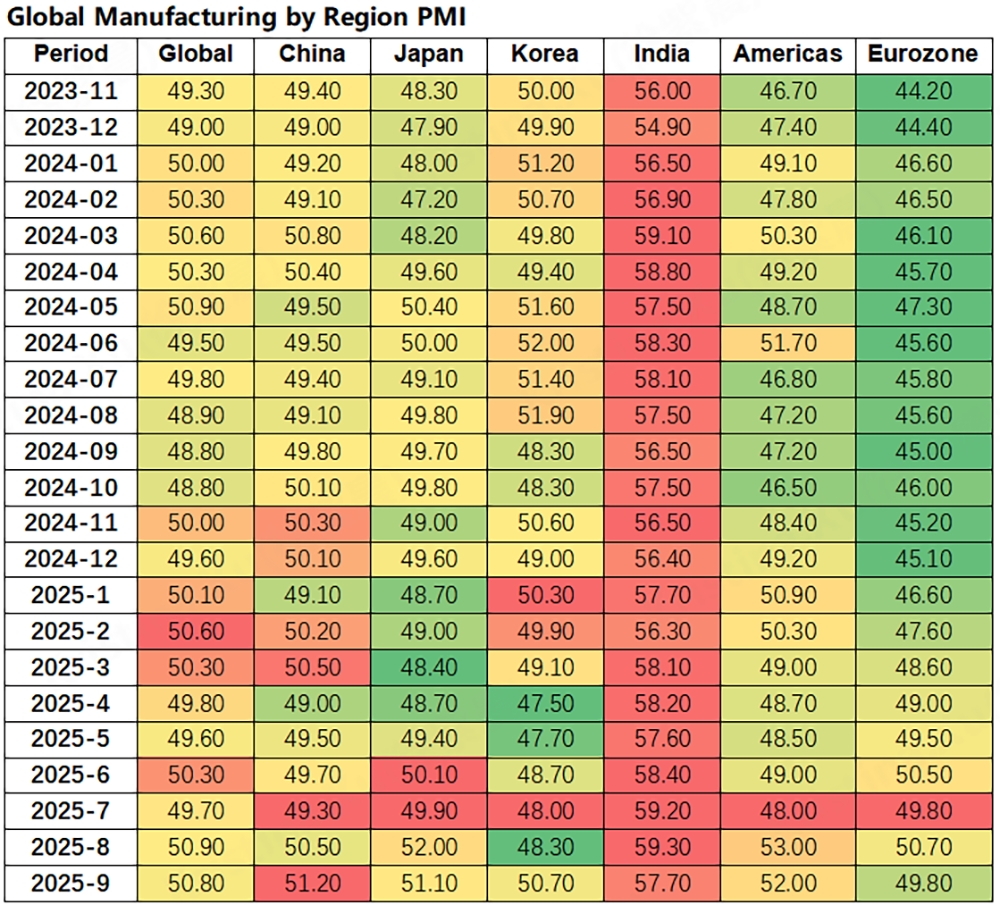

September Global Manufacturing PMI Edges Down to 50.8; Regional Recovery Shows Significant Divergence

Source: Wind

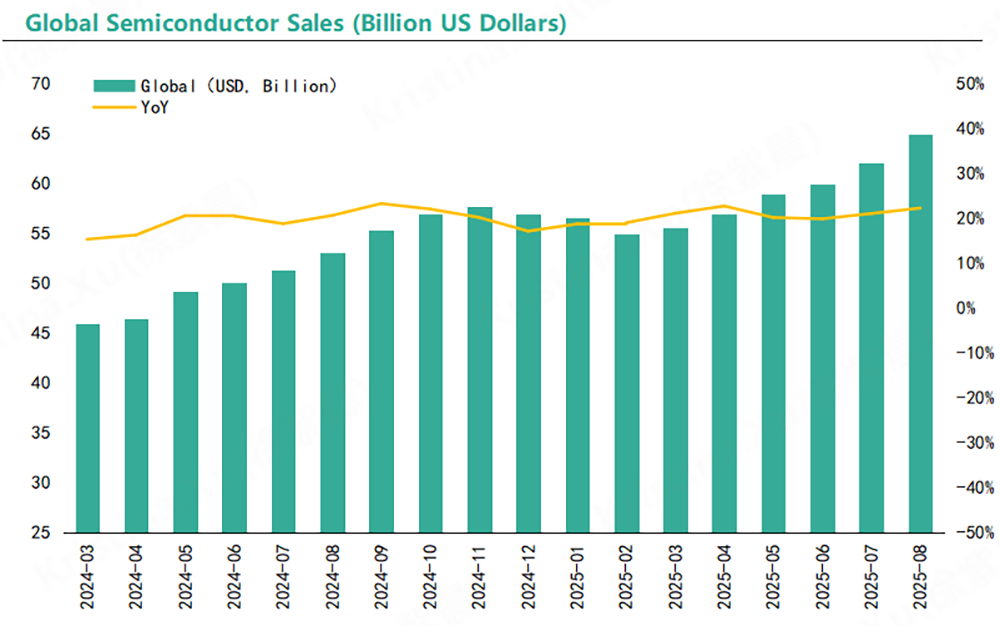

Global Semiconductor Sales Rise by 21.7% in August 2025, Strong Growth in APAC and Americas

Source: SIA

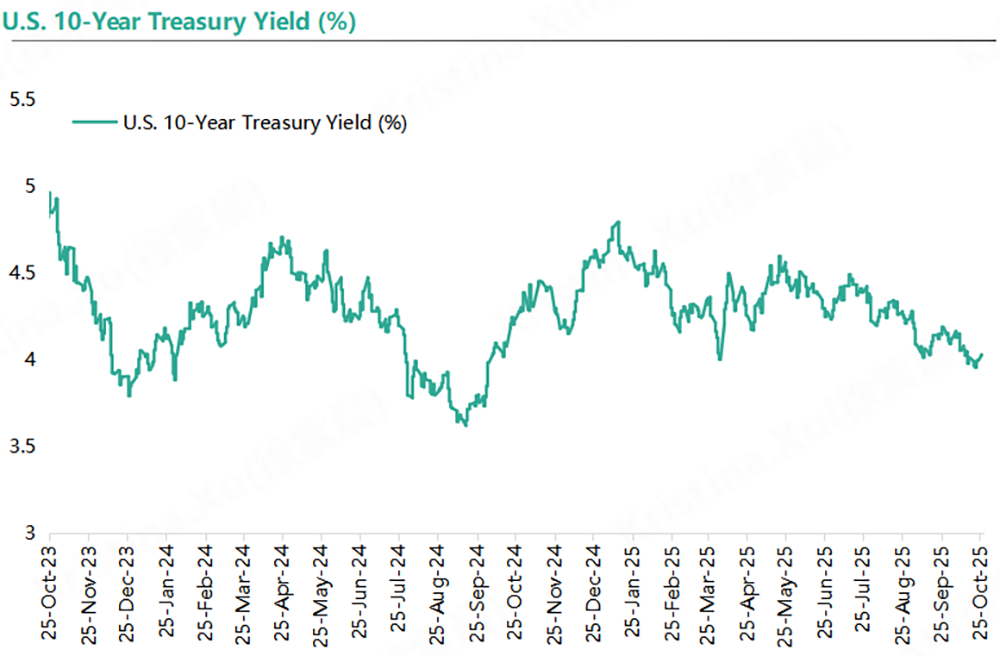

US 10-Year Treasury Yield: Volatile Downtrend in October, Dropping Below 4.0% Mid-Month

Source: Investing

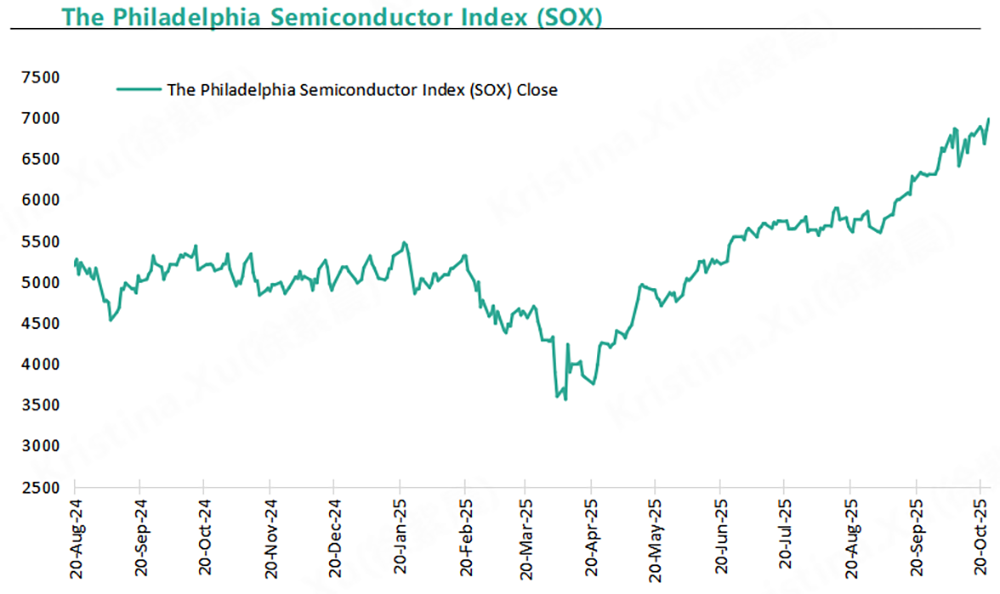

Philadelphia Semiconductor Index Trend in September-October: Policy Support and Earnings Recovery Drive Index Above 6900

Source: MacroMicro

2. Semiconductor Industry Updates

2.1 Short-term Implications

Nexperia: Supply Chain Disruptions Impact Global Automotive Industry, Multiple Automakers Face Production Halt Risks

NVIDIA: Market Capitalization Surpasses USD 5 Trillion Milestone, Reinforcing Leadership in AI Computing

Micron / Samsung / SK Hynix: Storage Chip Supply-Demand Imbalance Drives Price Increase Cycle

Samsung Electronics: Strong Storage Market Recovery Drives Notable Short-Term Growth

Micron: Strong Growth Driven by AI-Driven Storage Demand, with Both Earnings and Stock Price Seeing Significant Gains

NXP: Automotive Semiconductor Demand Shows Signs of Recovery, with Q3 Results Slightly Exceeding Market Expectations

Broadcom: Launches New “Thor Ultra” Networking Chip to Strengthen Its AI Data Center Portfolio

STMicroelectronics: Q3 2025 Earnings Reflect Persistent Weakness in Automotive Semiconductor Demand

SK Hynix: Q3 2025 Results Set Record as HBM Supply Lock‑In Secures Short‑Term Lead

GigaDevice: Short‑Term Earnings Surge Amid Storage Industry Recovery

2.2 Medium-term Implications

NVIDIA: Full‑Stack AI Strategy Accelerated, Mid‑Term Build‑out of a Comprehensive Technology Ecosystem

Analog Devices (ADI): “Fab‑Lite” Strategic Transition Optimises Mid‑Term Capital Deployment

Infineon: SiC Packaging Collaboration to Enhance Mid‑Term Supply‑Chain Resilience

Microchip: Industry’s First 3 nm PCIe 6.0 Switch Addresses AI Data-Center Interconnect Bottlenecks

SK Hynix: Launch of “AIN Family” AI‑Oriented Storage Solutions

Cmsemicon: Revenue Growth Amid Profit Pressure, Mid-Term Transformation Challenges

2.3 Long-term Implications

Silex: Silex Stake Sale Drives Short-Term Profit, Poses Long-Term Strategic Challenges

CXMT: Proposed 2026 STAR Market IPO, Strategic Valuation Significance

ASE: Major Investment in Advanced Packaging to Address Long-Term AI Chip Demand

Yageo: Acquisition of Shibaura Electronics Strengthens Long-Term High-End Component Portfolio

Skyworks & Qorvo: Strategic Merger to Reshape Long-Term RF Chip Market Dynamics

3. Application Updates

3.1 Artificial Intelligence

OpenAI and Broadcom Collaborate on Custom AI Chips

NVIDIA AI Chip Blackwell (GPU) Now Fully in Production in the U.S.

Qualcomm Unveils Two Data Center-Class AI Inference Chips

Intel Launches Next-Generation Data Center GPU

3.2 New Energy

CATL Advances Development of Sodium-Ion Passenger Vehicle Batteries

BYD Malaysia Plant Scheduled for 2026 Production

3.3 Consumer

Honor Launches Flagship Magic8 Series

vivo Unveils X300 Series Flagship Smartphones in Shanghai

Alibaba Cloud and NVIDIA Announce Physical AI Collaboration, Focusing on Embodied Intelligence and Assisted Driving

3.4 Industrial

Schneider Partners with Hongyu to Launch Okken Authorized Distribution Boards, Advancing Power Infrastructure Modernization

Rockwell Automation Launches Free FactoryTalk Design Workbench for Micro-Control Systems

3.5 Automotive

Automakers Scramble for Chips Amid Nexperia Supply Constraints

NVIDIA Unveils Hyperion 10: Integrated Hardware-Software Platform for Autonomous Driving

3.6 Telecommunication

ZTE Secures Top Position in China’s Cloud Terminal Market

NVIDIA Invests $1 Billion in Nokia to Advance AI-Driven 6G Networks

3.7 Medical Equipment & Devices

United Imaging Healthcare Signs INR 25 Billion Radiology Equipment Procurement Agreement with India’s Super Health

4. Product Updates

4.1 Memory Chips

Spot NAND and DRAM Supplies Tighten Across the Board, Memory Prices Rise Firmly

4.2 GPU

AI Demand Drives High-End GPU Shortages and Further Price Increases

4.3 CPU

AI Becomes the Dominant Driver, Powering Demand Across the Entire Value Chain

The content above represents a selected excerpt from our latest market intelligence report. For comprehensive coverage, in-depth analysis, and additional industry insights, don't hesitate to get in touch with us at marketing@briocean.com to request the full report.

Follow us on LinkedIn to receive market updates!

RECENT POSTS